Market risk refers to the risk of losses in an organisations trading book due to changes in equity prices, interest rates, credit spreads, foreign-exchange rates, commodity prices, and other indicators whose values are set in a public market. To manage market risk, organizations deploy a number of highly sophisticated mathematical and statistical techniques. Chief among these is value-at-risk (VAR) analysis, which over the past 15 years has become established as the industry and regulatory standard in measuring market risk.

What is VAR

Value at risk (VaR) is a tool used to measure and quantify the market risk, it can be simply defined as maximum possible loss a portfolio can suffer, due to market movements over a specific time frame.

VaR is specified with three inputs:

- A time frame

- A confidence level

- A potential amount of loss

For Eg. Say that 95% daily VAR of your assets is $5000, then it means that out of those 100 days there would be 95 days when your daily loss would be less than $5000. This implies that during 5 days you may lose more than $5000 daily.

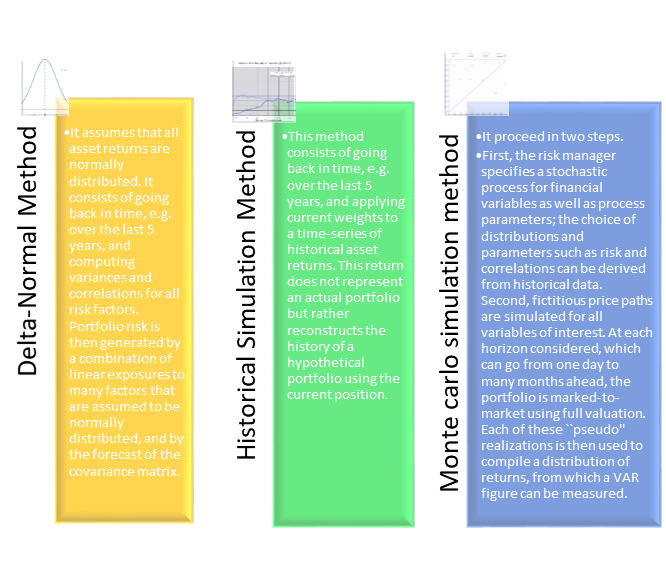

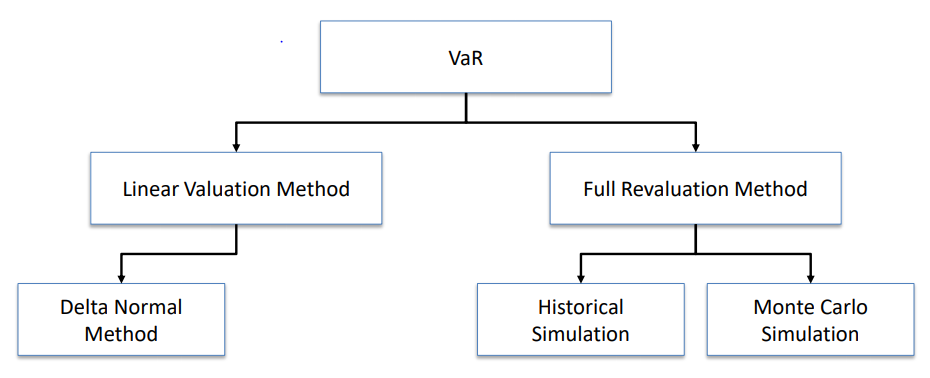

How to calculate VAR

Experiential Learnings – VAR in action

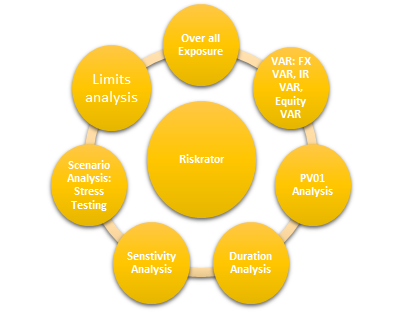

The demands placed on VAR and other similar techniques have grown tremendously, driven by new products such as power-reverse dual currency swaps, swaps whose notional value amortizes unpredictably, and dozens of other such innovations. To keep up, the tools have evolved. One of such tools is Riskrator. Riskrator is a proprietary tool developed by us for markets to do a complete deep-dive for the risk. It can be considered as one stop solution for all your risk related operations.

Major functions of Riskrator are:

- It computes net exposure including NOOPL.

- It perform duration analysis, computes durations (Maculay/modified/Key rate)

- It performs required sensitivity analysis (Earning impact of change in IR)

- It calculates VaR (FX, equity & IR).

- It performs stress test.