What is a Fund Transfer Pricing System and why is it needed?

A Funds transfer pricing (FTP) is the process through which banks

and other financial institutes allocate their earnings to the various lines of businesses in which they are engaged.

and other financial institutes allocate their earnings to the various lines of businesses in which they are engaged.

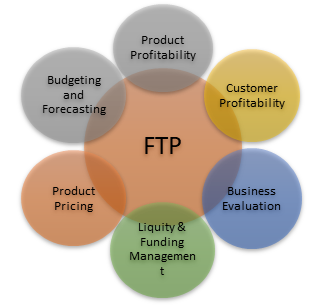

With the increased no. of business lines in an organizations, it is crucial to determine the profitability of each. Measuring profits on each level allows an internal comparison of effectiveness. A good FTP system would not only allows an organisation to do the required comparison but also enable following

- Allocating interest margins to assets and liabilities, in order to reflect cost of funding.

- Determining profitability of products and customers in order to boost changes in assets and liabilities structure that lead to increased total profits.

- Evaluating business decisions in organization basing on the contribution of branches and business lines to overall profits.

- Control of interest rate and liquidity risk by transferring it to the unit responsible for interest rate risk management

How to implement Fund Transfer Pricing System

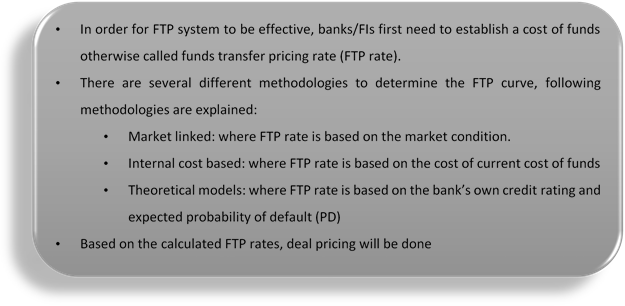

FTP framework will vary according to the size, activities and complexity of an organisation however a general approach will follow below steps.

Use Case

At G-square we help our clients to implement an effective FTP framework which uses the most updated and popular approaches prevailing in the industry.

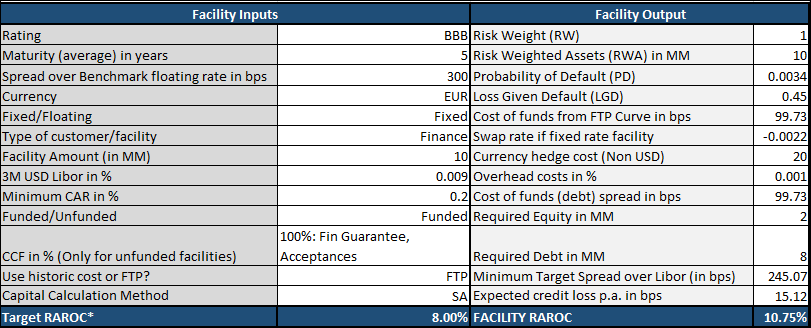

Depending on the client’s activities, size and complexity we develop excel models to calculate the FTP curves.

Based on these FTP rates, excel based pricing calculator will price the deals. The pricing calculator will return following outputs, the output parameters can be updated as per requirement.

Follow