USE CASE IN CREDIT RISK ANALYTICS

Background

The appetite for credit in a developing country like India is quite immense. The growing need of the large consumer Indian population and the Small & Medium Enterprises business segments (SME) for growing business to the next level is being tapped by the Indian financial institutions space. Most of them deal in the lending space for the retail, SME and Corporate segments. The want to build the probability of default model that enables the client to find out credit worthy customers which can be offered the lending facility. Usually a working capital and short term lending facility is need of the hour for every business

Problem Statement

The challenge for any Bank or financial Institution is to Identify eligible customers and the credit limits for each customer for the short tem facility

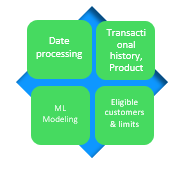

Approach

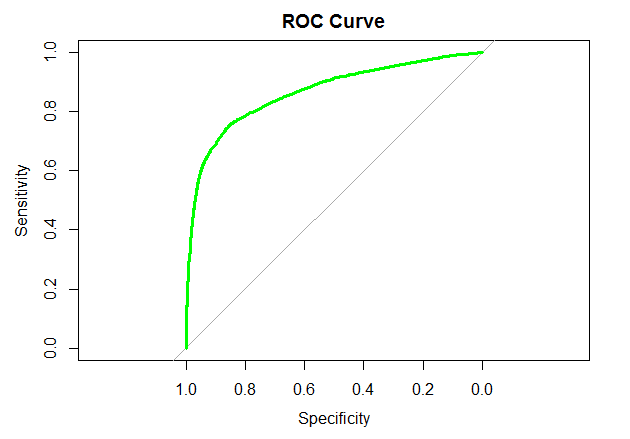

G-Square analysed various factors like demographic variables, repayment history and product holding of the customers. We identify the relationship of all the factors with respect to default expectancy and built a Probability of Default (PD) model using advanced machine learning algorithms.

The PD model gives the probability of default for each customer which help client to identify the customers which should not be given the lending facility with respective credit limits.

Solution

Customers with low probability of default are identified as eligible customers for the short term lending facility. The credit limits are also identified for disbursement. The Client is able to reduce the likely NPAs and knows the credit limit specific to each customer.

Follow