Introduction

Systematic Investment Plans in Indian Mutual fund industry is an important way of garnering inflows into Equity funds for the Indian Fund houses. The Industry has grown to regular monthly inflows of INR 10,000 crs with an investor base of around 46 million. However, each Fund House wants to grow its SIP book by up selling, cross selling and customer acquisition etc. Involvement of Machine Learning and Artificial Intelligence in mutual funds is increasing at a very high rate to grow the SIP book. Below are the most popular Use cases where AI & ML based Data analytics is used to increase sales and retention:

- Cross Sell of SIP: Capture target investors/customers who are have not taken any SIP before but are very likely to start

- Up Sell of SIP: Identify investors who already have SIP but are likely to take one more SIP in a different Scheme

- Retention: Identify the customers who are likely to stop the SIP and how long will they continue the SIP which can help the organisation to take actions in advance

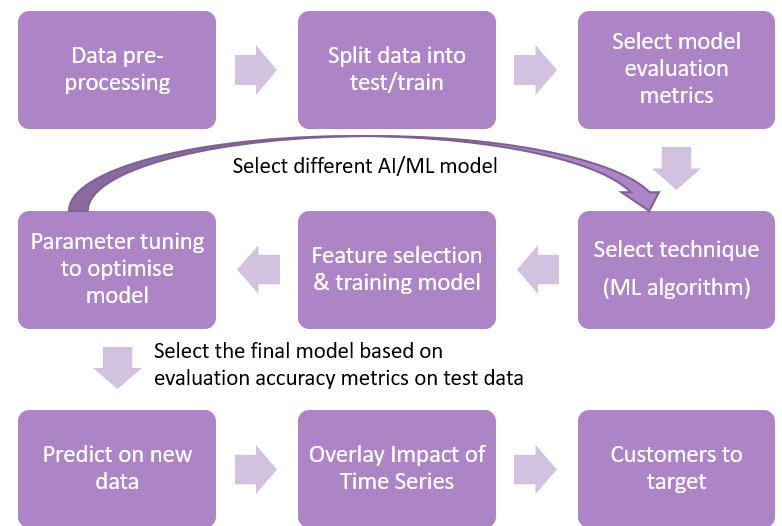

ML Model Process

Historic trends, demographics, past transactions and so on will be used to build different machine learning algorithms like Decision Tree, Random Forest, XGBoost algorithms which will capture the pattern bases of the past behaviour of different input features and give them weightages to identify customers who are highly likely to buy a product by predicting the propensity for each customer to buy.

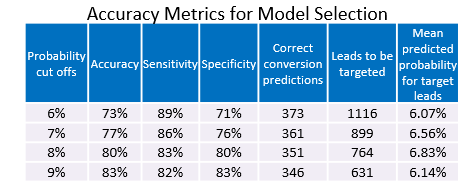

After looking at the different accuracy metrics such as Sensitivity, Specificity, Information Gain we will select the optimum model to identify customers who are highly likely to buy a product by predicting the propensity for each customer to buy.

*Sensitivity:It is the ability of a test to correctly classify an individual as ′Potential Investor’

*Specificity: It is the ability of a test to correctly classify an individual as ′Non-Potential Investor’

*If the goal of the test is to identify everyone who are Potential Investors, the number of false negatives should be low, which requires high sensitivity.

Through the application of machine learning models, the model provides organizations with each customer’s likely transactional behaviour based on customers’ demographic profiling & past transactional data. The functionalities of the model will be Cross sell SIPs, Cross sell other schemes, Up Sell SIP and SIP retention Modelling.

Major Factors affecting the likelihood of a customer to buy or stop SIP:

Time Series Impact

Apart from predicting who will invest in SIP or stop an SIP, we also have to predict when the activity will happen. We will have to use time-series modelling to tackle this. For this purpose, we use the following factors:

- Performance of the fund i.e. returns

- Performance of overall market (reflected in equity indices)

- Seasonality – quarter or month of activity

Output

SIP Up Sell: We have identified the investors who have taken SIP in the past and have a very probability to take another SIP.

SIP Cross Sell: We identified the investors who have not taken SIP in the past but are very likely to buy a SIP.

SIP Retention: We have identified the investors having propensity to stop the SIP along with the quarter in which they will stop.

Summary Of Customers to Target:

| Category | Total Population | Target Investors |

| SIP Up Sell | 300000 | 75000 |

| SIP Cross Sell | 200000 | 92000 |

| SIP Retention | 400000 | 40000 |