Credit Card Behaviour Scorecard Model for a Large International Bank

Introduction:

One of the areas where banks usually need credit risk analytics strongly is in building behaviour based scorecards to assess the current status of customer and portfolio health check in the assets products space. We have been working extensively in that space. Here we are sharing the experience we had in the Credit cards behaviour scorecard modelling.

The client was looking to create a behaviour scorecard model to predict whether an existing customer holding a credit card is going to default. This is a common practice in the banking industry to mitigate credit risk. To create a behaviour scorecard model, we gathered data on various factors such as the customer’s payment history, credit utilization, and other relevant financial and demographic information. Using this data, we built a predictive model that assigns a score to each customer, indicating their likelihood of defaulting on their credit card payments.

The behaviour scorecard model can be an effective tool for the bank to identify high-risk customers and take proactive measures to prevent credit losses. By using data-driven insights, output targeted support to at-risk customers, such as payment reminders, payment plans, or credit counselling.

Approach:

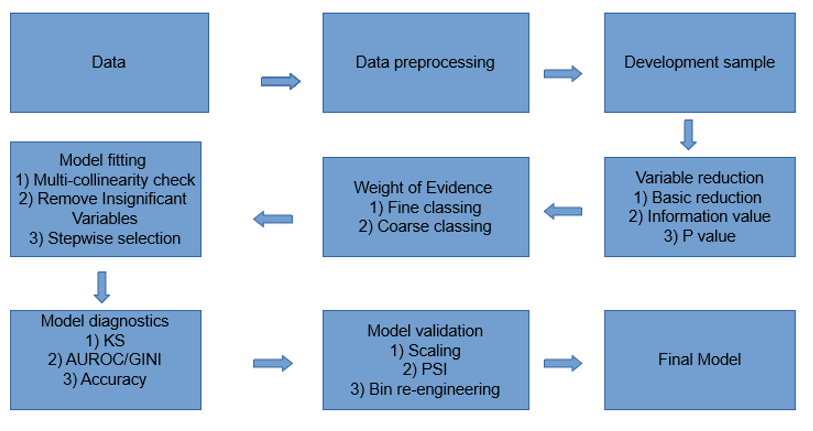

We used internal behaviour data such as payment history, transaction history, delinquency status, and month on books to develop the behaviour scorecard model. Roll rate analysis was done to determine the good and bad definition, and vintage analysis was used to determine the performance window.

We also used two out-of-time samples to validate the performance of the model. Binning of variables was done to obtain the weight of evidence (WOE) and information value (IV), which are useful for determining the predictive power of each variable. Finally, logistic regression was used to predict the probability of default.

To evaluate the performance of the model, various metrics were used, including KS, AUROC, GINI, PSI, Accuracy, and F1. These metrics are commonly used in credit risk modelling to assess the accuracy and robustness of the model.

Overall, we used a rigorous and data-driven approach to develop the behaviour scorecard model, which is a best practice in credit risk management. It is important to note that the model should be periodically reviewed and updated to ensure that it remains relevant and effective in predicting credit risk.

Solution:

We created three scorecards for three types of cards, which were segmented based on days past due (DPD). The points to double the odds methodology was used to arrive at the scores.

The points to double the odds methodology is a statistical approach used in logistic regression analysis to transform the coefficient estimates into a more interpretable scale. The resulting points can be used to create a scorecard, which assigns points to various factors based on their predictive power.

In this case, the bank used the DPD as a segmentation variable, in credit risk management. By segmenting the cards based on DPD, the bank can apply different risk management strategies to each segment, depending on their level of credit risk.

Overall, the use of scorecards and the points to double the odds methodology is a best practice in credit risk modelling, as it allows banks to make data-driven decisions and mitigate credit risk effectively.