Introduction:

In finance, both speed and accuracy matter a lot. When pricing portfolios, we often need to project thousands of future cash flows considering interest, defaults, prepayments, and reserves across multiple investor tranches.

These calculations are usually done in Excel using complex formulas and macros. While that works for small datasets, it becomes very slow as data grows.

In one of our projects, an Excel model took nearly 15 minutes to process just 500 securities, which made real-time analysis impossible.

To solve this, we rebuilt the model completely in Python, using modern computation methods. The result : the process became 15 times faster, scalable, and transparent.

🎯 The Challenge:

The Excel model performed:

- Security-level cash flow projections

- Adjustments and amortization logic

- Modeling of prepayments (CPR) and defaults (CDR)

- Calculation of losses and recovery flows

- Tranche-level waterfall allocation — distributing payments across senior, mezzanine, and equity layers

While the logic was correct, Excel’s loops and dependencies made it very slow. Running scenarios or testing new assumptions was frustrating.

Our goal was clear:

Build a Python-based Whole Security Pricing Engine that replicates the same business rules, can handle thousands of securities, and runs everything in under a minute.

⚙️ The Python Solution:

We broke the system into two layers:

- Security-Level Cash Flow Projection

- Tranche-Level Waterfall Simulation

Each layer was reworked using vectorized computation, Numba JIT compilation, and modular Python functions for better structure and speed.

🏦 Security-Level Modeling:

At the core, each security needed to be projected month-by-month, capturing the impact of:

- Adjustments

- Prepayments (CPR)

- Defaults (CDR) and Loss Severity (LS)

- Delinquencies (DQ)

- Reserve account inflows

Using Numba’s @njit, we have compiled loop-heavy calculations into machine code, giving C-like performance directly from Python.

@njit def project_single_sec_numba(balance, orig_rate, term, cdr, cpr, ls, dq, months): # Security-level amortization, prepayment, and default logic cashflows = np.zeros((months, 10)) for t in range(months): # Interest, scheduled principal, prepayment, default, and recovery ... return cashflows

This approach reduced the time to simulate a single security from milliseconds to microseconds crucial when scaling to large portfolios.

💧 Tranche-Level Waterfall Logic:

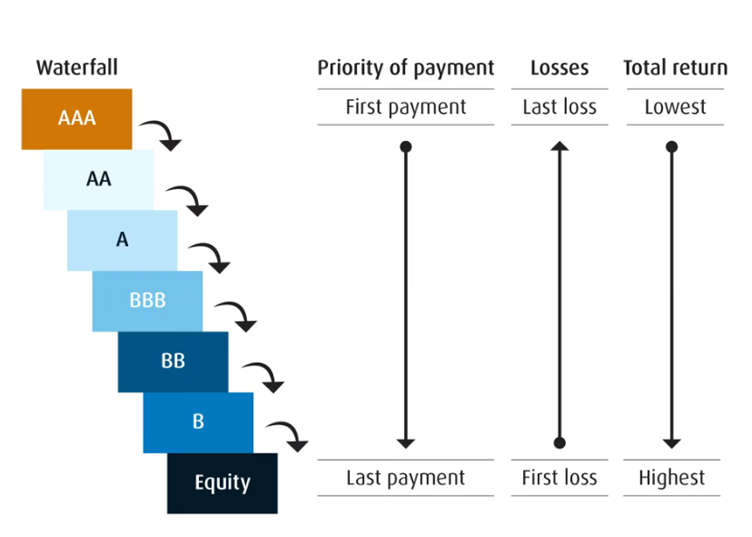

Next came the waterfall, how payments are distributed across tranches:

- Senior tranches get priority principal and interest.

- Mezzanine tranches are next, absorbing some risk.

- Junior/Equity tranches get residual interest after covering losses.

I built a Numba-optimized waterfall function that dynamically allocated payments based on tranche structure, coupon rates, and loss absorption order.

@njit def calculate_tranche_cashflow_numba(starting_balance, tranche_thickness, tranche_coupon, net_loss): # Apply waterfall priority: senior → mezzanine → junior → equity ... return tranche_interest, principal_payments, losses

The model also simulated loss write-downs, reserve inflows, and available excess spread, mimicking real-world structured finance behavior.

📊 Performance and Results:

After integrating both layers, the model achieved:

| Metric | Excel Model | Python Model |

| Processing Time(500 securities) | ~15 min | <1 min |

| Scalability | Limited | Thousands of securities |

| Transparency | Hidden macros | Readable, auditable Python logic |

| Flexibility | Fixed formulas | Dynamic scenario simulation |

The engine now:

- Generates monthly security and tranche cash flows

- Calculates equity NPVs and IRRs using numpy_financial

- Produces clean, auditable Pandas DataFrames for reports and analysis

🔍 Stress Testing and Scenario Analysis:

Once performance improved, we added stress testing to simulate different market situations:

- Interest rate changes

- Prepayment rate variations

- Default and loss sensitivity

This made it easy to run Monte Carlo–style simulations and study how yields or durations shift under pressure.

📈 Business Impact:

The new Python-based engine:

- Reduced processing time by 15×

- Enabled instantaneous re-pricing and scenario-based stress testing

- Improved transparency for auditors and analysts

- Allowed integration into APIs for automated security evaluation pipelines

It turned a static Excel process into a scalable, automated, and data-driven financial model connecting traditional finance with modern data science.

🧠 Key Learnings:

- Numba can make Python models run almost as fast as C without losing readability.

- Separating security-level and tranche-level logic keeps the model clean and easy to debug.

- Combining finance knowledge with tools like Pandas and NumPy can produce powerful analytical models.

- Moving from Excel to Python improves not just speed but also transparency and reliability.

🏁 Conclusion:

Financial modeling is changing rapidly. It’s not just about building formulas anymore it’s about scaling and automating traditional workflows.

By converting Excel models to Python and using tools like Numba, Pandas, and NumPy-Financial, we can bring speed, accuracy, and clarity to every part of financial analytics.

Follow