Reactivation of Inactive Customer base through ML

Introduction

In the retail funds & Investments industry, one of the key challenges is to retain and grow the customer base, especially in the context of increasing competition and changing customer preferences. One of the strategies to achieve this goal is to activate existing inactive or partially inactive customers through cross-sell and upsell of products and services to existing customers, based on their needs and preferences.

However, not all customers are equally responsive to cross-selling and upselling offers. Some customers may be inactive, meaning that they have not made any transactions or interactions with the mutual fund company for a long period of time. These customers may have lost interest, switched to other providers, or faced some barriers or constraints that prevented them from continuing their relationship with the mutual fund company.

Reactivating these inactive customers is a valuable opportunity for the mutual fund company, as it can help to increase the customer lifetime value, reduce the customer acquisition cost, and improve customer loyalty and satisfaction. However, reactivating inactive customers is not an easy task, as it requires understanding the reasons for their inactivity, identifying their potential to invest, and designing effective and personalized offers that can motivate them to resume their relationship with the mutual fund company.

One of the use cases where artificial intelligence and machine learning-based data analytics can be used to increase sales and grow the SIP book is by reactivating the existing inactive base of customers. In this article, we will discuss how to formulate the problem statement, approach, use case.

Problem Statement

The problem statement of reactivating inactive customers of the Investments world can be formulated as follows:-Given a base of retail fund customers who have invested earlier and withdrew later, how can we identify and target the customers who have a high propensity to invest again, and what are the best cross-selling and upselling offers that can be made to them?

Approach ML Model Process

The following flow chart diagram illustrates the steps of the approach:

Models

The models that can be used to solve this problem can be classified into two types: 1) Propensity models and 2) Recommendation models.

Propensity models: These are models that can predict the probability or likelihood of a customer performing a certain action or behavior, such as investing again, given their characteristics and history. These models can be based on supervised learning techniques, such as logistic regression, decision trees, random forests, gradient boosting, neural networks, etc., or unsupervised learning techniques, such as clustering, association rules, etc. These models can help to segment the customers based on their propensity scores and to prioritize and target the customers who have a high propensity to invest again.

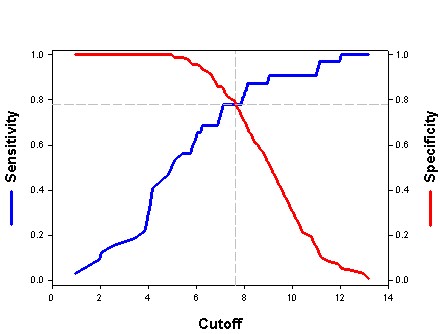

Recommendation Models: After looking at the different accuracy metrics such as Sensitivity, Specificity, and Information Gain we will select the optimum model to identify customers who are highly likely to buy a product by predicting the propensity for each customer to buy.

Sensitivity: is the ability of a test to correctly classify an individual as a Potential Investor

Specificity: It is the ability of a test to correctly classify an individual as ‘Non-Potential Investor’

If the goal of the test is to identify everyone who is a Potential Investor, we will take a cut-off with high Specificity.

Outcome and Application

Through the application of machine learning models, the model provides organizations with each customer’s likely transactional behavior based on customers’ demographic profiling & past transactional data. The Investment management company uses the identified customer base data to pitch specific funds through digital marketing modes. The approach being higher propensity of the customers will lead to the ultimate objective of the company of conversion of the suggested funds and leading to an Active Customer base.

Follow