PD & Credit Setting Model

For a Large Bank

CLIENT & PROBLEM STATEMENT

- The client is one of the new age large listed bank in India.

- The Client has various products in Assets and liabilities with vintage clients in different product segments.

- Objective of this project was to build the probability of default model that enabled the client to find out credit worthy customers which can be offered the temporary lending facility.

- The second objective was to Identify the credit limits for each customer.

APPROACH

- G-Square analysed various factors like demographic variables, repayment history and product holding of the customers.

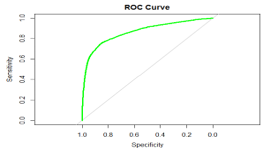

- We identified the relationship of all the factors with respect to default expectancy and built a Probability of Default (PD) model using advanced machine learning algorithm.

- The PD model gives the probability of default for each customer which help client to identify the customers which should not be given the lending facility with respective credit limits.

SOLUTION & OUTPUT

- Customers with low probability of default were identified as Eligible customers for the lending facility.

- The credit limits were also identified for disbursement.

- Client is able to reduce the likely NPAs and knows the credit limit specific to each customer after the model was implemented.