Option Strategies

FINALYTICA June’17

There are a number of reasons an investor would use options. These include speculation, hedging, spreading, and creating synthetic positions. Some of them are described below:

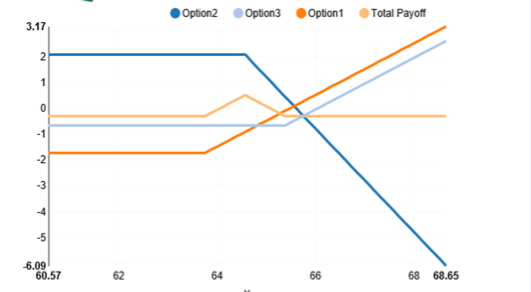

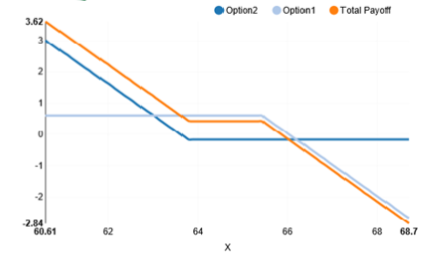

1) Bull call spread :

Description: This strategy consists of buying one Call option and selling another at a higher strike price to help pay the cost.

Payoff: Both the potential profit and loss for this strategy are very limited and very well-defined: The maximum profit is limited to the difference between the strikes price, less the debit paid to Put on the position.

Break Even: This strategy breaks even at expiration if the stock price is above the lower strike by the amount of the initial outlay (the debit). In that case, the short Call would expire worthless and the long Call’s intrinsic value would equal the debit.

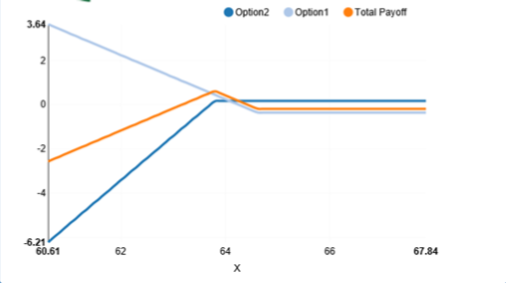

2) Butterfly call spread:

Description: Short two Calls at the middle strike, and long one Call each at the lower and upper strike.

Description: Short two Calls at the middle strike, and long one Call each at the lower and upper strike.

Payoff: The potential profit and loss are both very limited. An investor who buys a butterfly pays a premium somewhere between the minimum and maximum value, and profits if the butterfly’s value moves toward the maximum as expiration approaches.

Break Even: The strategy breaks even if at expiration the underlying stock is above the lower strike or below the upper strike by the amount of premium paid to initiate the position.

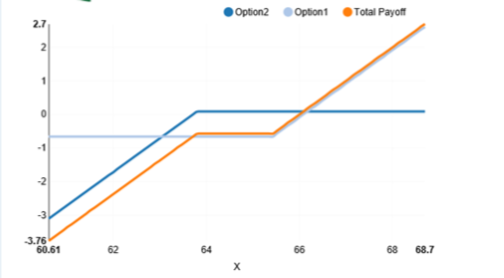

3) One by two call spread:

Description: Short one Call  and long two Calls of the same expiration but with a higher strike.

and long two Calls of the same expiration but with a higher strike.

Payoff: This strategy has an unlimited profit potential, but the potential loss is limited.

Break Even: When the stock is above the upper strike by the difference between the strikes the loss has been offset. To break the stock needs to go still higher by the amount of the debit to reach a complete breakeven.

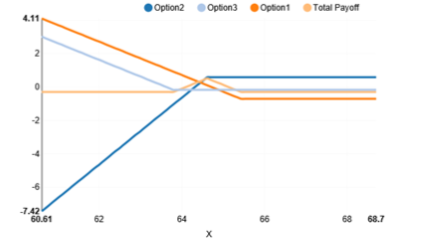

4) Bullish Risk reversal:

Description: This strategy consists of selling a call and buying a put option.

Description: This strategy consists of selling a call and buying a put option.

Payoff: This strategy establishes a fixed amount of price exposure for the term of the strategy. The long Put provides an acceptable exit price at which the investor can liquidate if the stock suffers losses. The premium income from the short Call sets a limit to the upside profit potential.

Break Even: In principle, the strategy breaks even if, at expiration, the stock is above/ (below) its initial level by the amount of the debit/(credit). If the stock is a long-term holding purchased at a much lower price, the concept of breakeven isn’t even relevant

5) Bear put spread:

Description: A Bear Put Spread consists of buying one Put and selling another Put,  at a lower strike, to offset part of the upfront cost.

at a lower strike, to offset part of the upfront cost.

Payoff: Both the potential profit and loss for this strategy are very limited. The net premium paid at the outset establishes the maximum risk, and the short Put strike price sets the upper boundary,

“The maximum profit= strike prices – debit paid to Put on the position.”

Break Even: This strategy breaks even if, at expiration, the stock price is below the upper strike by the amount of the initial outlay (the debit). In that case, the short Put would expire worthless, and the long Put’s intrinsic value would equal the debit. “Breakeven = Long Put strike – net debit paid.”

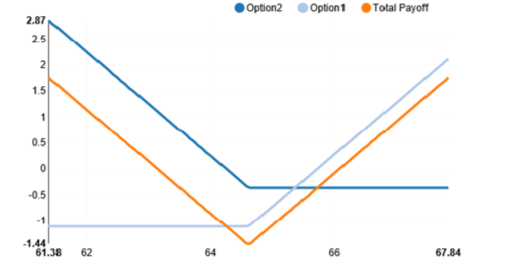

6) One by two put spread:

Description: Short one Put and long two Puts of the same expiration but with a lower strike.

Description: Short one Put and long two Puts of the same expiration but with a lower strike.

Payoff: Should the stock fall and all the options go deep in-the-money, the Bull Put Spread has a (-)value equal to the diff between the strikes and the Long Put has a(+)value equal to the difference between the lower strike and stock’s price.

Break Even: Consider the strategy at expiration for the underlying stock; when the stock is below the lower strike by the difference between the strikes the loss has been offset.To break even, the stock needs to go still lower by the amount of the debit to breakeven.

7) Butterfly put spread:

Description: Long two Calls at middle strike, and short one Call each at lower and upper strike.

Payoff: The potential profit and loss are both very limited. An investor who sells a butterfly receives a premium somewhere between the minimum and maximum value, and profits if the butterfly’s value moves toward the minimum as expiration approaches.

Break Even: The strategy breaks even if at expiration the underlying stock is above the lower strike or below the upper strike by the amount of premium received to initiate the position.

8) Bearish risk reversal:

Description: The strategy combines two option positions: short a Call option and long a Put option with the same strike and expiration.

Description: The strategy combines two option positions: short a Call option and long a Put option with the same strike and expiration.

Payoff: As with a short stock position, the potential profit is substantial, and the potential losses are unlimited.

Break Even: At expiration, the strategy breaks even if the stock price has declined by an amount equal to the premium paid for the option. “Breakeven = Initial short sale price – premium paid”

9) Long straddle:

Description: A Long Straddle is a combination of buying a Call and Put,  both with the same strike price and expiration.

both with the same strike price and expiration.

Payoff: The maximum potential profit is unlimited on the upside and very substantial on the downside. If the stock makes a sufficiently large move, regardless of direction, gains on one of the two options can generate a substantial profit.

Break Even: This strategy breaks even if, at expiration, the stock price is either above or below the strike price by the amount of premium paid.

10) Long strangle:

Description: Long a Call option and long a Put option with the same expiration, but where the Call strike price is above the Put strike price. Typically both options are out-of-the-money.

Description: Long a Call option and long a Put option with the same expiration, but where the Call strike price is above the Put strike price. Typically both options are out-of-the-money.

Payoff: The potential profit is unlimited on the upside and very substantial on the downside. The loss is limited to the premium paid for the options.

Break Even: This strategy breaks even if, at expiration, the stock price is either above the Call strike price or below the Put strike price by the amount of premium paid.

News and Updates

Learn more about the latest happenings in the financial analytics world from our monthly newsletters