Application scorecard using Clientrator for a NBFC

For a NBFC

CLIENT & PROBLEM STATEMENT

- The client is one of the NBFC in the country in the SME space.

- Focus on SME loans and Venture Debt.

- Objective of the project was to build a risk score card model which helped the client to find out the customers that can be offered a lending facility.

APPROACH

- G-Square analysed the different factors like demographics, banking behaviour and repayment history of customers and identified most important factors.

- We checked and identified the relation of all the factors with respect to the Probability Of Default using various statistical tools and advanced Machine learning algorithms.

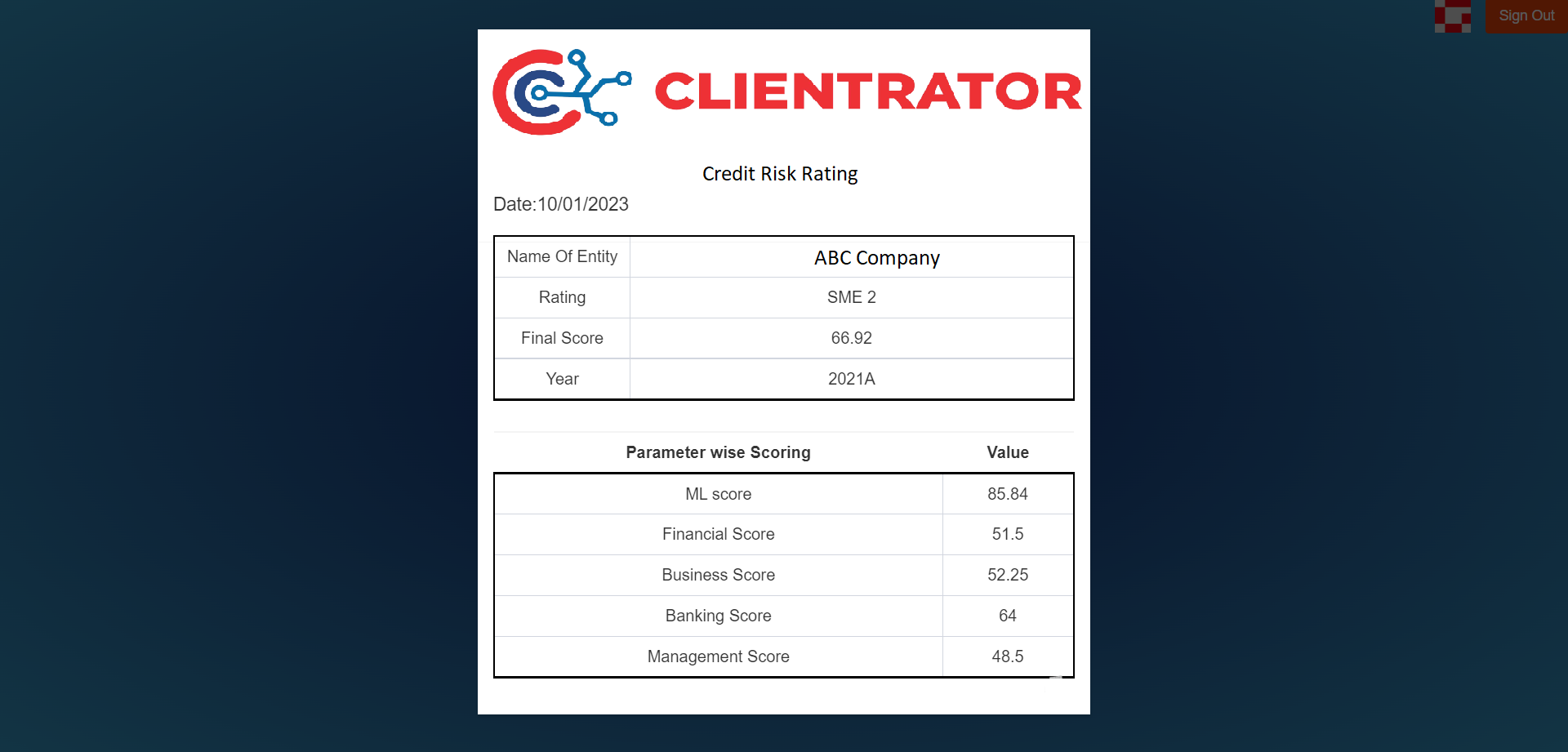

- The credit risk score model gives score basis four parameters i.e. Financial, Business, Banking and Management for each customer.

- We checked relationship of features as the data size increased & changed some factors as input & further tuned our model to get a higher sensitivity which reduced the good loan rejection % by 2%.

SOLUTION & OUTPUT

- The solution was automated using our productified solution & now implemented in API mode using its predictive analytics Product Clientrator which generates risk score & tracks PD’s of customers.

- Tool is used for ongoing scoring of new loan applications for identifying good & bad customers & taking call of giving lending facility or not.Customers having low risk score were identified as good customers & vice versa.