Loss Given Default (LGD) modelling

For a large Asian Bank

CLIENT & PROBLEM STATEMENT

- The Client is one of the universal banks.

- It has strong customer base in the region.

- The Client wanted to identify the estimated potential credit losses, so we calculated loan’s projected profitability.

- Under IFRS 9, banks are required to recognize credit losses at all times based on reasonable information, considering past, current and future events.

- Models for expected credit loss (ECL) were to be developed using the past information and performance of existing and former clients.

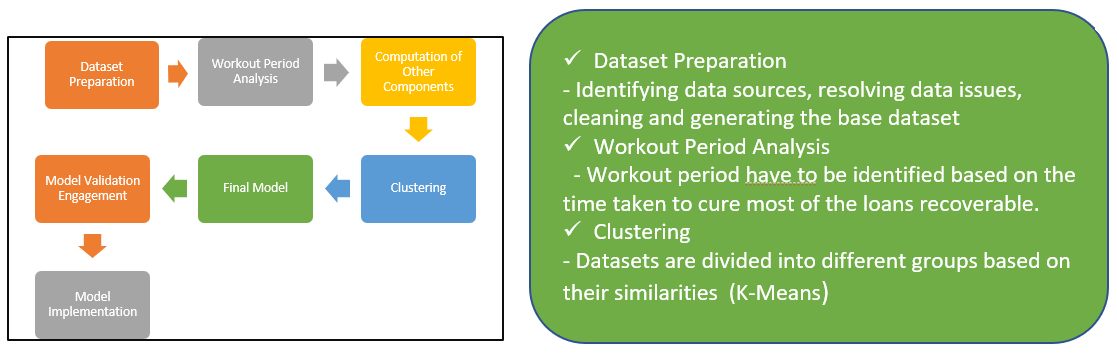

APPROACH

- Identified data sources, resolved issues, cleaned and generated the base dataset for the model development.

- We identified the optimal workout period for recoverable loans with precision and accuracy.

- We used K-Means clustering, an unsupervised machine learning algorithm, to form cluster centroids and group the data points by minimizing their distances from the centroids.

- Obtained LGD for specific customer segments using either data-driven clustering or business logic.

SOLUTION & OUTPUT

- Accurately projected future LGD with macroeconomic adjustments.

- Calculated LGD in ECL calculations and loss mitigation strategies for more reliable estimates.