Forecasting LGD through Macro-factors modelling

For a Large Bank

CLIENT & PROBLEM STATEMENT

- The Client is one of the leading banks in Asia.

- It has strong customer base in retail, corporate and NR space.

- The Client wanted to use Macro-economic data of the past to forecast the Recovery rates for the next 5 years using Time Series modelling.

- The aim was to take historic monthly data of the past to forecast for future months.

- This time series modelling was to be performed for two products of the bank i.e. Cards and Personal Loans.

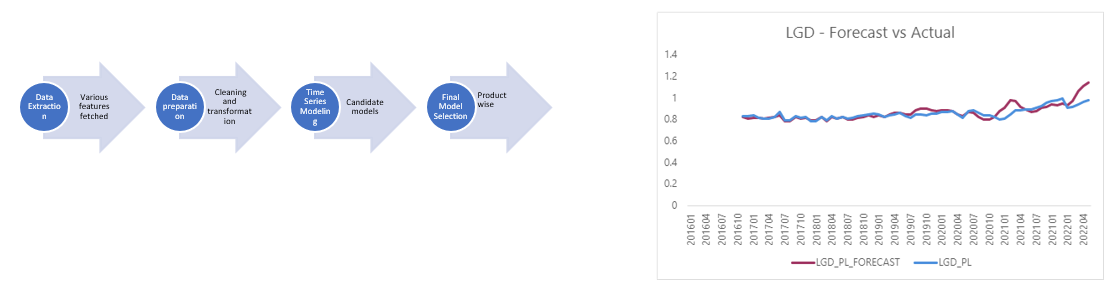

APPROACH

- Initially, the macro-economic data was cleaned and transformed to bring it to the desired format. The respective Recovery rates were then mapped to this data.

- Out of the complete list of macro-factors, the macro-factors that were influential with respect to the LGD were shortlisted.

- Various pre model tests relevant to Time Series Modelling were performed and data was again transformed accordingly. Finally, the models were created and shortlisted on the basis of the model validation tests and accuracy.

- Out of the shortlisted macro-factors, models created on combinations of 3 or more macro-factors were tested and finally, 5 candidate models were finalized.

SOLUTION & OUTPUT

- Out of all Candidate Models, 1 best performing model was selected.

- LGD forecasting was then automated and implemented.