ECL Methodology Modeling

For a Large NBFC in India

CLIENT & PROBLEM STATEMENT

- The NBFC is one of the leading Private sector NBFCs in India.

- They have a large Lending portfolio comprising Retail and Corporate.

- The Company wanted to validate the ECL methodology using macroeconomic PD modelling, incremental PD modelling & LGD modelling.

- The Portfolio comprises of LAP, Business loans, Home Loans etc.

APPROACH

- Macroeconomic factors like Nominal GDP, Real GVA, Real Agriculture, Food Credit etc for India for the prediction of transition PD bucket.

- Linked historic Transition PD buckets (quarterly) for each risk segments through Principal Component Analysis and Logistic Regression.

- Factored U-shaped and V-shaped recovery over next five years.

- Using the model and macro-economic projections, we projected forward looking segment wise defaults and PIT PDs.

SOLUTION & OUTPUT

- We provided the projected quarterly PDs and annual PDs.

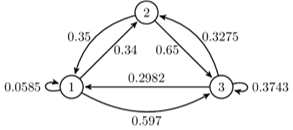

- Project PDs product-wise and Rating/Bucket-wise, Transit matrix of PDs were also given.

- We projected macro-factors using economist forecasts and statistical modeling.

- Implemented Markov-Chain model on the annual transition probabilities (PT PDs) to calculate the cumulative state transition metrics.