ECL Framework

For a Midsize SME and Retail Focussesd NBFC

CLIENT & PROBLEM STATEMENT

- The client is a mid size Retail & SME lending focussed NBFC.

- The NBFC wanted a ECL Framework to calculate the expected credit loss based on fair value to approach to value the term-loan book.

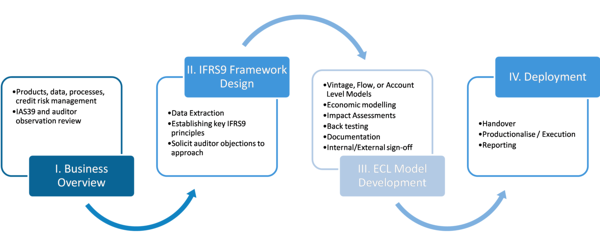

APPROACH

- Analyze past DPD and NPA data to create annualized rolling NPA rates.

- Develop annualized PD for each DPD bucket to get roll rates by DPD bucket and vintage/residual maturity.

- Use external benchmarks for adjusting for application score card and analyze the recovery rates.

- Develop ECL calculation model.

SOLUTION & OUTPUT

- The Client got the desired ECL Framework which was not existing to evaluate appropriate Credit loss provisioning, Portfolio Futuristic PIT PDs.

- Facility level PITD PD incorporating rating and DPD.

- Facility-wise ECL aggregated at portfolio level.