Derivator

Price and analyze simple to complex derivatives on the go. Available as web-app, mobile app or APIs.

Request a Demo

Derivator has been crafted to meet your expectations

-

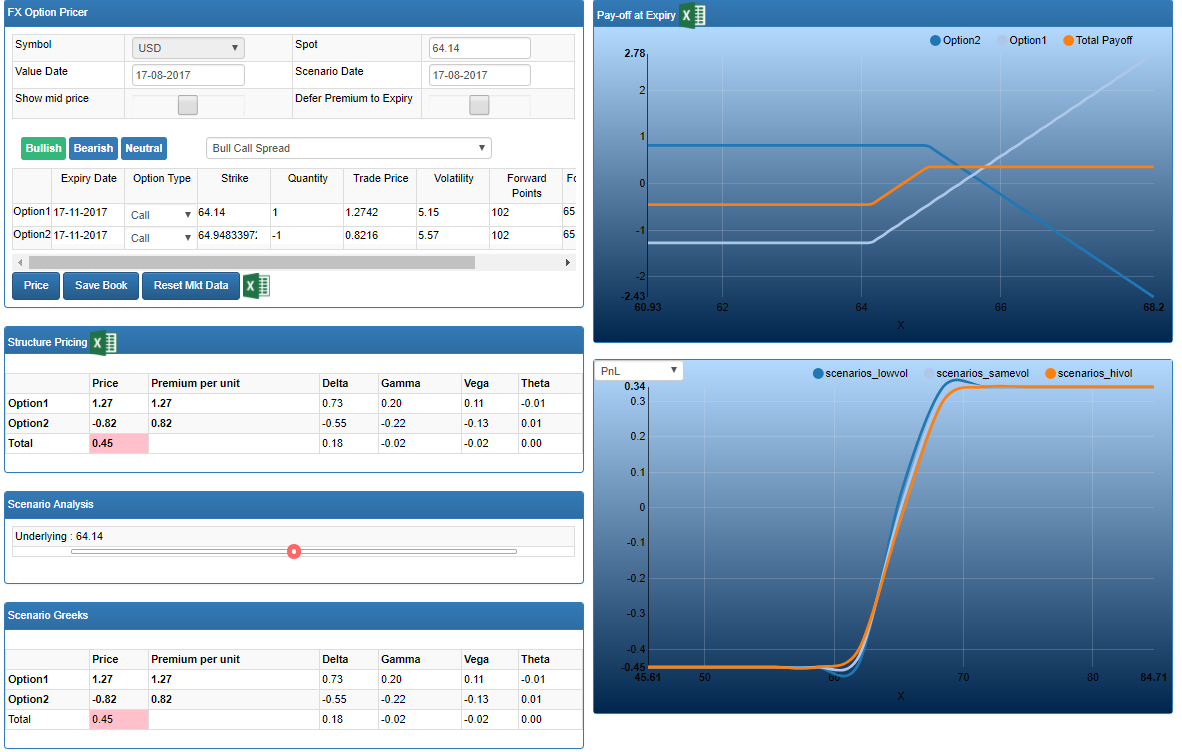

Perform pricing & scenario

It can analyse single trades, strategies or books in a unified platform.The users can get the likely P & L and Risks associated with a single or multiple trade strategies.

-

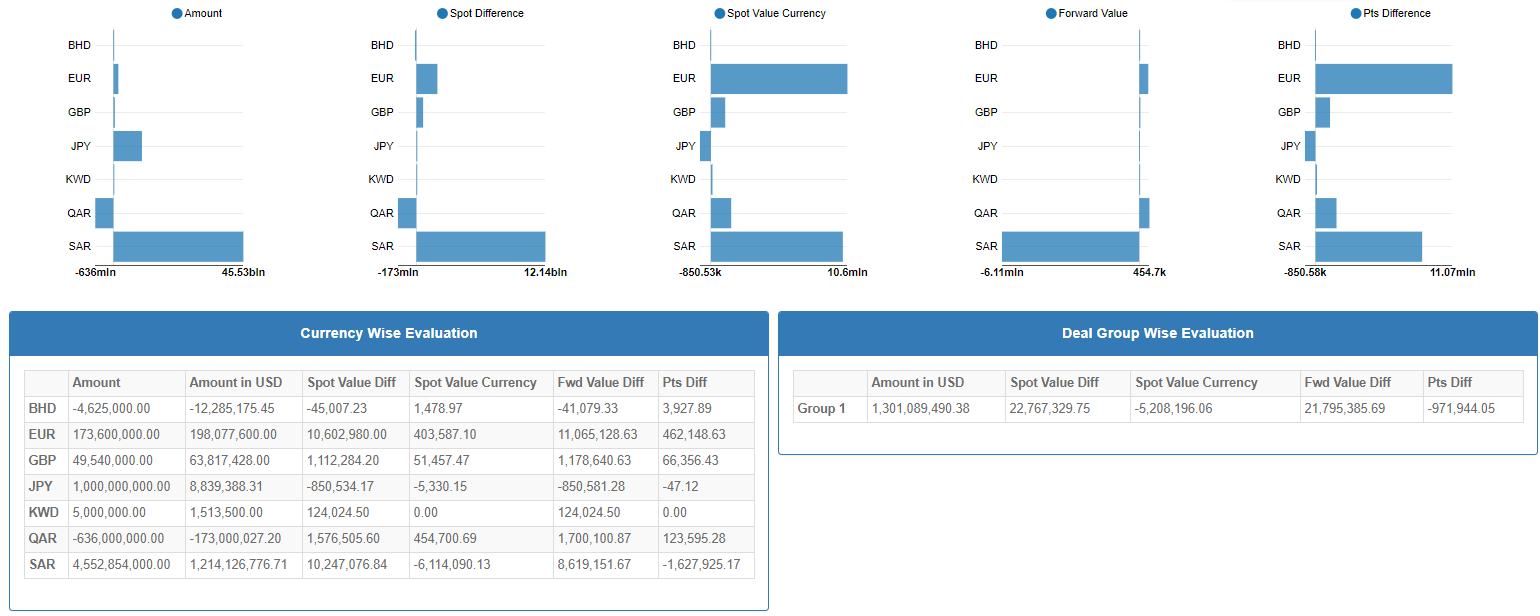

Manage Books

Risk teams can get consolidated view of risks of the derivative book which can be used for regulator reporting, internal risk monitoring and limit monitoring.

-

Access anywhere

Can be accessed as online tool, mobile app, excel addin, REST API or Python API

USE CASES AND BENEFITS

Risk Management

Risk teams can get consolidated view of the risks of the derivative book. This can be used for regulator reporting, internal risk monitoring and limit monitoring.

Pricing on the front desk

Dealers can use Derivator for pricing vanilla and exotic deals on the go. On the go pricing can help dealers/traders trade in the derivatives more effectively.

Derivative Sales

Sales people can access Derivator for analyzing strategies, and traders for demonstrating the same to the clients. As the product is accessible from various devices Derivator eases the sales process for the derivative sales person

DERIVATOR MODULES

- For pricing Fx options

- For banks, brokers and corporates

- Used for pricing Equity options

- Primary users are portfolio managers, asset managers and brokers

- Interest Rate (IR) swaps, swaptions, cap-floors

- For use by banks, insurance companies, pension funds and corporates

- Structured notes, hybrids etc.

- For banks, wealth management and HNIs

Time to give it a try

Time to give it a try

As we told, there’s no substitute to hands-on experience. Try Derivator for free

Request a demo Try it on your own