Customer Analytics Model

For a Large Bank

CLIENT & PROBLEM STATEMENT

- The client is a large private sector bank in India with a significant savings and current account holders base.

- The Client has various products in Assets and liabilities with a mix of vintaged and new clients.

- The client wanted to identify the potential customers from their existing customer base, to whom they can sell targeted third-party products.

- The client also wanted to know when and how to target these prospects.

APPROACH

- G-Square analysed the demographics, buying pattern & banking behaviour of customers and identified most important factors which affects the propensity of buying the third-party products.

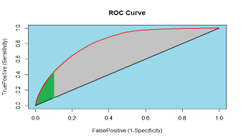

- Using these factors, G-Square developed a robust Propensity Model using ‘R’ tool.

- G-Square also analysed the time series data to identify the time period for targeting the set of prospective customers.

- Customers are prioritized or de-prioritized based on the Data Science models at various sales process stages.

SOLUTION & OUTPUT

- A higher conversion rate was observed from the past, which led to a marked increase in revenue and at the same time efficiency.

- A few thousand customers were identified with the help of propensity model, who have very high propensity to buy targeted products