Customer Attrition analytics model

For a Large Bank

CLIENT & PROBLEM STATEMENT

- The client is a large private sector bank in India with a large savings and current account base.

- Along with their own products, client also sells third party products like Life Insurance, Health Insurance, Mutual Funds etc.

- Client has been selling these products with sales push strategy across all the regions.

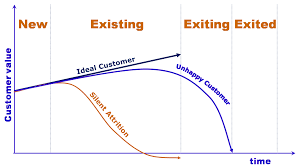

- Client wanted to ring fence its existing customer by identifying customers prone to leaving the bank.

- The client also wants to know if they are likely to attrite fully or may have product specific attrition.

APPROACH

- G-Square analysed the demographics, buying pattern & banking behaviour of customers and identified most important factors which affects the attrition of customers.

- G-Square created the model keeping an overall attrition and a product level attrition.

- The focus is to create high engagement and right product strategy for the customers to do a win-back.

SOLUTION & OUTPUT

- G-Square’s productified solution was implemented and was used to track the ‘high propensity to attrite’ customers.

- At random check by RMs it was observed that the model was able to identify 70% customers who were thinking of moving out of the bank.

- Using these factors, G-Square developed a robust Attrition analytics Model using various tools and models.