SIP Analytics Up sell & Cross sell

For a Large Asset Management Company

CLIENT & PROBLEM STATEMENT

- The client is the largest Asset management company with more than ten million customers.

- They provide various mutual fund schemes in various asset class categories.

- They wanted to maximize sales of their systematic investment plan (SIP) options of equity funds to their customer base through the Digital marketing channel.

APPROACH

- The database we worked on was the Debt schemes data to suggest cross sell into equity schemes through the systematic investment route.

- By using Machine Learning, we provided cross-sell analytics (Debt to Equity) for identifying the propensity of each customer to buy a particular scheme in equity.

- We built multiple classification ML models such as DecisionTree Classifier, RandomForest Classifier, AdaBoost and XgBoost and evaluated the accuracy metrics to select the most optimum model.

SOLUTION & OUTPUT

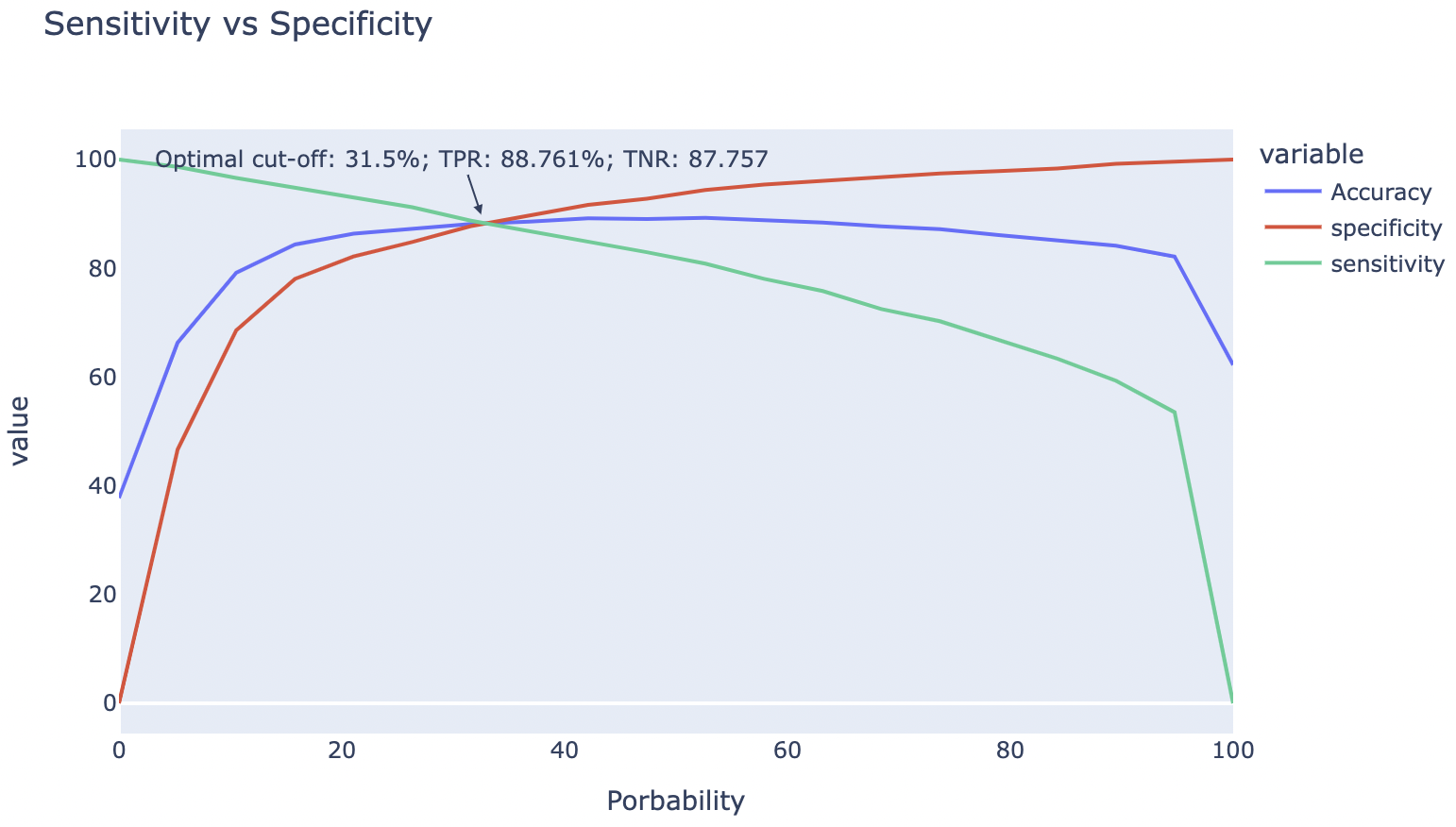

- The final model will have AUC metrics and will have a stable Sensitivity and Specificity.

- The output we provided Product identification & target list of customers who will invest through the SIP route.

- The fund house ran digital marketing campaigns on the identified customer base and got a penetration of 7% on the identified AI list.