Customer Analytics

For a Large Financial Products Distributor

CLIENT & PROBLEM STATEMENT

- The client is a India’s fastest growing financial services Group which has present across India through 100+ branches over 20 states.

- The client wanted to reach out to customers having high propensity to invest in tax saving scheme – a) cross-selling to existing equity fund customers and b) up-selling more to existing tax savings customers

APPROACH

- Encoding of categorical variables has been done and transactional variables are transformed using standardization and log transformation.

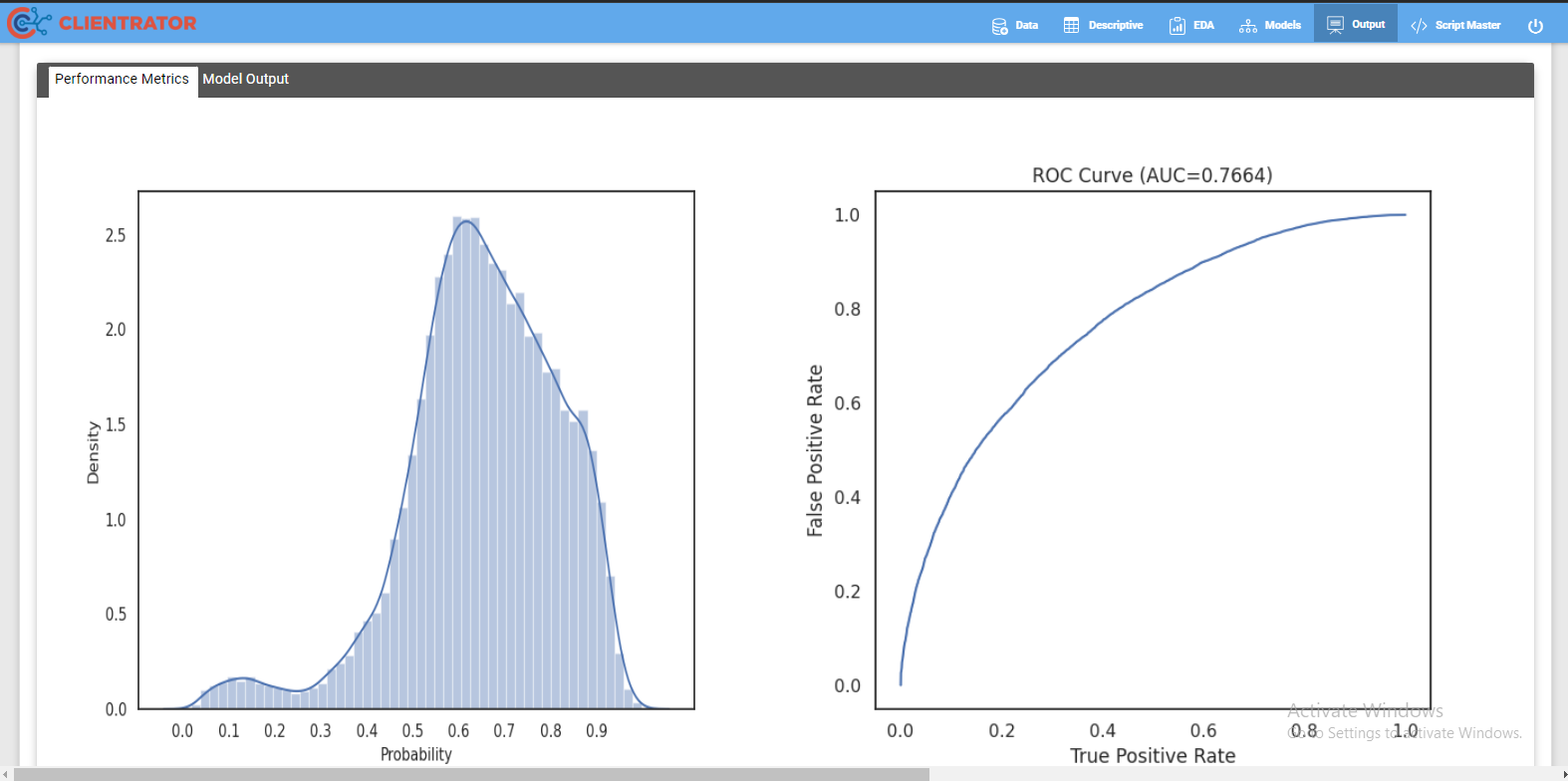

- PCA for dimensionality reduction has been performed and several ML models like Decision tree, Random Forest, XG boost etc. has been developed and best performing model were selected for propensity of customers.

- For Up-selling target model has been made considering historical ELSS amount invested.

SOLUTION & OUTPUT

- The target customer for cross-selling and up-selling were identified.

- As the whole set up was integrated with Clientrator, our predictive analytics tool, and entire process is automated starting from data fetching to model building and scoring customers.