Credit Score Card

For a Fintech Company

CLIENT & PROBLEM STATEMENT

- The Client is on of the biggest online payment gateways & the Client has about 20 million customers.

- More than half a million transaction per day are done through the platform, It serves more than 10,000 merchants.

- The client wanted to extend temporary credit facility to some customers for ease of transactions.

- There is no customer demographic data for credit scoring, the transactional data is huge and unstructured.

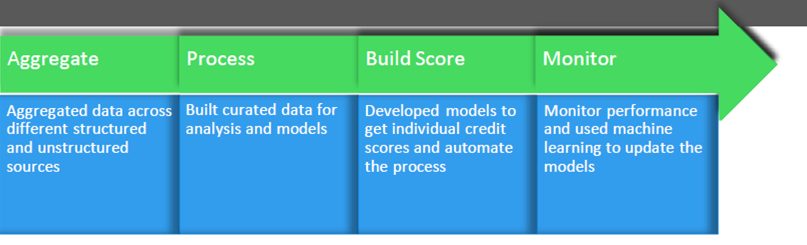

APPROACH

- G-Square helped build rules on top on transaction and web-behavioural data for credit scoring.

- Benchmarking was done on actual default/delayed payment data.

- The rules were automated using big-data tools.

- Machine learning was used to automatically update the rules on an ongoing basis.

SOLUTION & OUTPUT