Credit Risk Process & Automation

For a Fast Growing bank

CLIENT & PROBLEM STATEMENT

- The client is a fast-growing private sector Indian bank & has a large SME customers in the asset book.

- Data required to monitor credit risk of various facilities given to the SME customers is scattered in various systems and databases.

APPROACH

- Underwriting , Compliance, Risk areas where to be covered.

- Review, Unhedged Foreign Currency , Quarterly Review, Risk Based Pricing, FTP, Rating modules were developed.

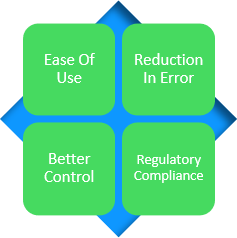

- Credit risk process automation helps in scaling up the business faster and gives competitive advantage in a digital world.

- Currently monitoring and controls were being done using excel sheets and temporary activities.

- The client required automation and better processes in portfolio risk monitoring and controls.

SOLUTION & OUTPUT

- G-Square built a comprehensive risk data mart for monitoring portfolio risk

- G-Square has automated data entry and risk controls at various levels.

- The risk mart is used for MIS, Analytics and identifying specific controls.

- The processes automated included: Underwriting standards, Risk based pricing, Foreign currency exposure.