Credit Card Behaviour Scorecard Model

For a Large Bank

CLIENT & PROBLEM STATEMENT

- The Client is a leading Universal bank in Asia.

- It has strong customer base in retail, corporate and NR space.

- The Client wanted to create a behaviour scorecard model in order to predict whether the existing customer who is holding credit card is going to default.

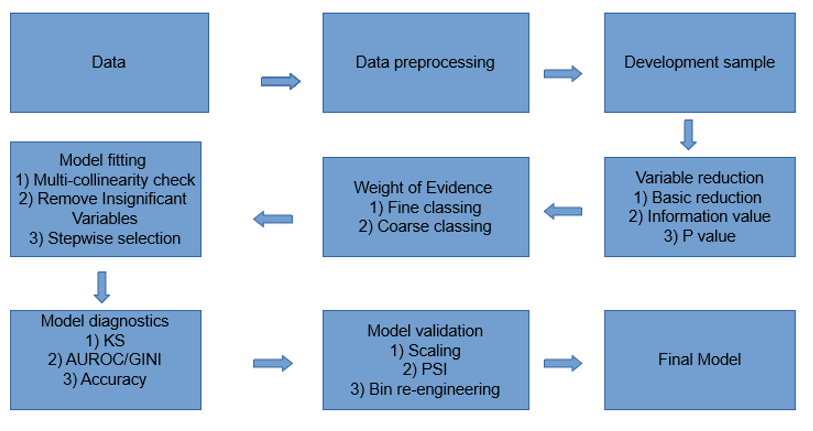

APPROACH

- Internal behaviour data i.e. payment, transaction, delinquency, transaction, month on books etc. of customers was used to develop the model.

- Roll rate analysis was done in order to get the good and bad definition. Vintage analysis was done in order to get the performance widow.

- Two out of time samples were taken to check the performance of the model.

- Binning of variable was done to get the weight of evidence(WOE) and information value(IV).

- Finally, logistic regression was fitted to predict the probability of default.

- Model performance was checked using KS , AUROC , GINI , PSI , Accuracy , F1 score , Precision , Recall.

- Points to double the odds methodology was used to arrive at the scores.

SOLUTION & OUTPUT

- Three scorecards were created for three types of cards.

- The segmentation of the cards was done on the basis of days past due (DPD).