Covid Impact Modeling

For a Bank in Jordan

- The Bank is one of the leading Private sector in Jordan, They have a large Lending portfolio comprising Retail and Corporate .

- The Bank wanted to predict the impact of Covid on futuristic PIT Probabilities of Defaults (PDs) for their portfolio considering the current environment for this year and subsequent years.

- Portfolio included Vehicles, Credit card, Mortgage, PL, SME & Corporate loans.

- Macroeconomic factors of Jordan like GDP growth rate, Inflation rate, Unemployment, Interest rate, Real estate price index for the prediction of PDs were used.

- We linked historic PDs (quarterly) for each risk segments with economic variables and performed Logistic regression.

- Based on statistical analysis different variables were used for modeling of each product..

- We projected macro-factors using economic forecasts and statistical modeling.

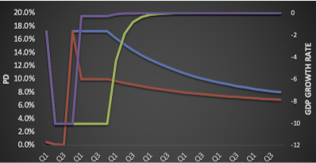

- We provided the projected quarterly PDs and annual PDs.

- Using the model and macro-economic projections, we projected forward looking segment wise defaults and PIT PDs .

- Projected PDs Product-wise, Rating wise and DPD Bucket-wise.

- PDs are being used by the bank for their analysis and IFRS accounting.

- Factored U-shaped and V-shaped recovery over next five years.