Channel Segmentation

For A Large Stock Exchange

CLIENT & PROBLEM STATEMENT

- The client is the largest Stock Exchange of the Country.

- They are a platform to trade in Equities, Fixed Income, Currency, Commodities etc through its Broker/Member network.

- The Client wanted to know how the 1500 odd members trade in various asset classes on the exchange.

- Client wanted to determine appropriate engagement strategy with each Member to increase their business on the exchange.

APPROACH

- We collected the data pertaining to the volumes, value of each member over a longer period of time.

- We used various parameters like trading data on transactions, value, asset class, products, timing skewness of the trades, growth/trends over a period of time, linkage to the markets & correlation, kind of investors, consistency etc.

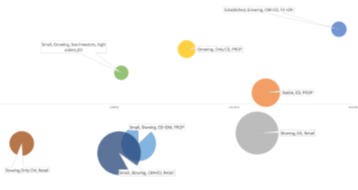

- We built Clustering analysis based on the above data and classified each Member to cohesive groups.

- The classification like Growing, Investing in rising markets, investing in bearing markets, consistent, slowing were created based on multi-dimensional parameters.

SOLUTION & OUTPUT

- The Exchange house got a Member segmentation analysis based on the Clustering we had created for theme based on the approach.

- The Exchange is using the analysis for increasing the business based on business strengths and where there are gaps.