Business Intelligence Solution

For a Mortgage Lender Company

CLIENT & PROBLEM STATEMENT

- The client is a Mortgage Lender company based out in the UK.

- They wanted to set up a Business Intelligence solution for their required business Reports.

- They required few Reports and Dashboards to be created.

APPROACH

- The data was fetched from MSSQL database through an ETL process using PySpark, SQL queries and Python programming.

- The required mapping was being done using the Tables and the Data Dictionary provided by them.

- After the data was fetched, the required reports and dashboards were developed as per the requirements.

- The process of ETL was automated through the Cron Job so that the data will get updated on a daily basis.

SOLUTION & OUTPUT

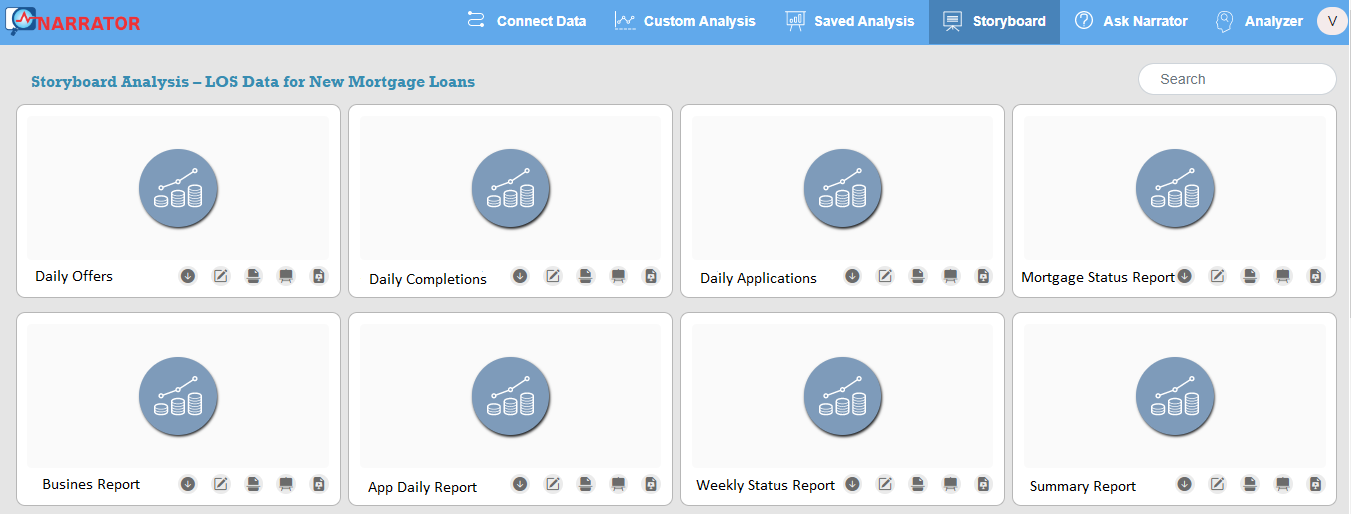

- Narrator setup was being done and all required reports & dashboards were created.

- The BI solution has given automated BI solution on the LOS data with required reports for the Business, Finance and Operations teams.