Problem statements

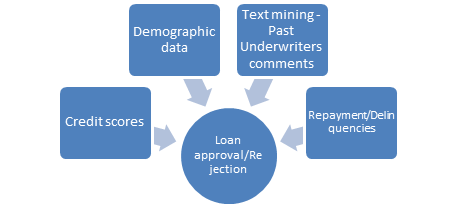

Customers typically wants to automate the process of loans underwriting by using applicants personal data & underwriters comments data of past applications. Thus Clients want an automated solution for processing loans on the go for onboarding new customers

Solutions

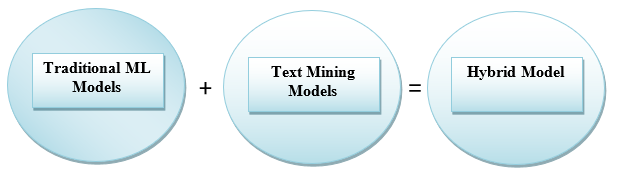

We analyse the demographics, various scores of applicants & textual comments & identify most important factors which will help in the rejection or approval of applications. Using our Bigdator product libraries, G-Square we develop a robust Credit Underwriting Analytics Model using Machine Learning. We look into various classification ML models plus text mining models to arrive at the final model for loan approval/reject process.

We use traditional ML models and Text mining models on underwriter comments to arrive at a hybrid model to score the risk associates with borrowers. We create lookalikes for similar category of borrowers to predict the likely acceptance of rejections of new customers being evaluated for the loan facility.

The ML productified solution is used to automatically predict the Approval/Rejection process of new loans on the go

Follow